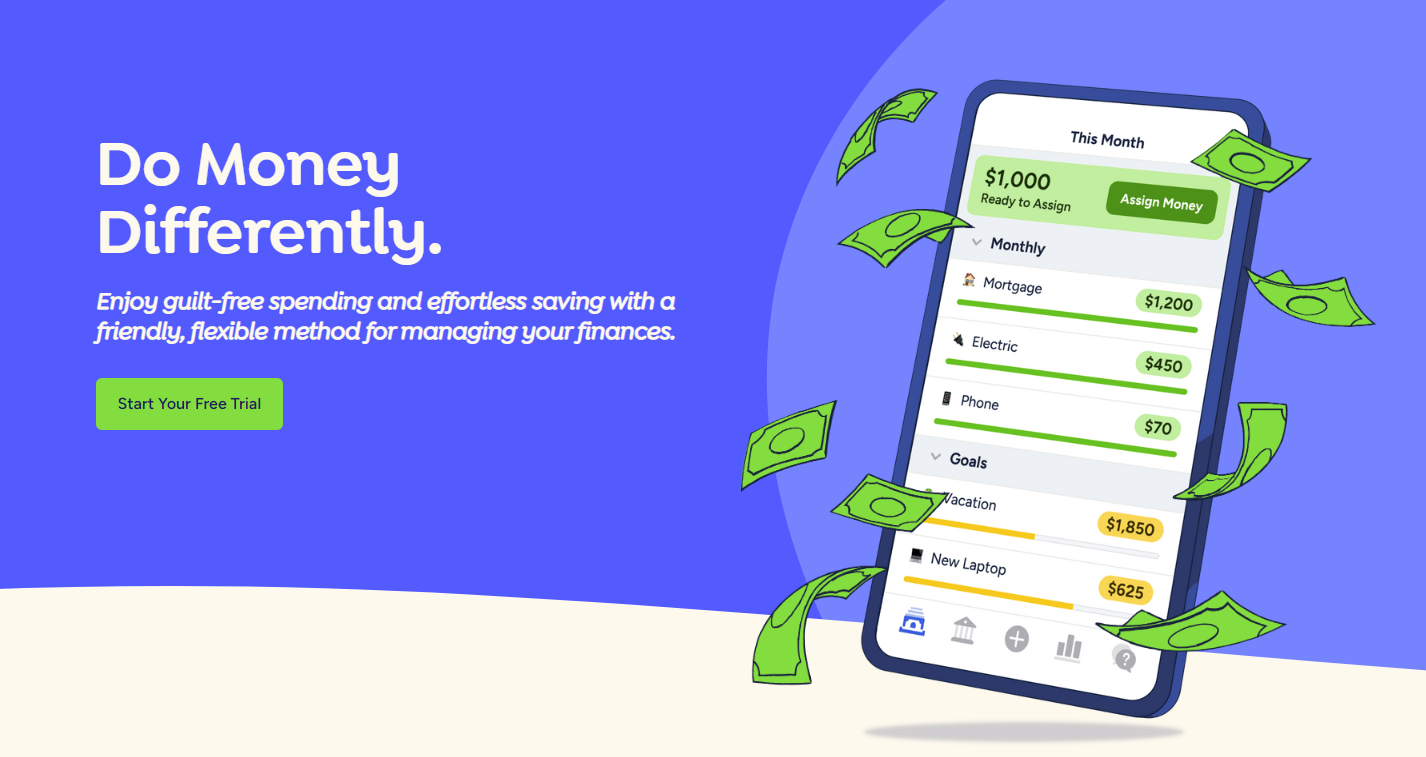

YNAB, known as You Need a Budget, is a nifty app designed to help people manage their finances. The main idea behind YNAB is to give every dollar a job, which means budgeting becomes a more hands-on, intentional process. This app is all about making you the boss of your money.

This post contains affiliate links. If you purchase through these links, I may earn a commission at no extra cost to you.

When you first jump into YNAB, it might feel like you’re learning a new skill. The setup is straightforward, though. You start by linking your bank accounts, setting your initial budget, and defining your financial goals. It’s like building a road map for your money.

The interface is clean and user-friendly, even for those who shy away from complicated tech. You’ll find it easy to navigate through your budget categories, transactions, and reports. YNAB provides plenty of help with tutorials and webinars to get you up and running in no time.

So, the crux of YNAB is its philosophy. Instead of budgeting to restrict your spending, YNAB encourages mindful spending. You’re not saying ‘no’ to things you want; you’re planning and saving for them. This makes the whole process feel a lot more empowering.

In a nutshell, getting started with YNAB might seem a bit daunting at first, but once you get the hang of it, you’ll appreciate the control and clarity it brings to your financial world.

How Does YNAB Work?

YNAB operates on the principle of proactive budgeting. You allocate every dollar you earn to a specific purpose, ensuring your money is working for you and not disappearing into thin air. This method isn’t just about tracking spending but about planning for the future.

One of YNAB’s key features is its ability to sync accounts in real-time. Whether you add transactions manually or import them from your bank, everything stays up-to-date. This allows for an accurate picture of your finances at any given moment.

How does YNAB help if budgeting isn’t your strong suit? The app teaches you to prioritize and make informed spending decisions. Its budget categories and goals guide you to allocate funds for necessities first, like rent and groceries, before moving on to wants and savings. Think of it as having a financial coach that’s available 24/7.

The features don’t stop there. YNAB offers tools for goal-setting and tracking, ensuring you can see your progress over time. Whether you’re saving for a vacation, an emergency fund, or paying off debt, there are specific features to help you stay on track.

Another handy aspect is the reporting feature. YNAB generates detailed reports that break down your spending habits. With these insights, you can see where your money’s going and adjust your budget as needed.

In essence, YNAB makes budgeting interactive and manageable. It’s designed to be a hands-on tool that brings clarity and control to your financial life, regardless of your budgeting skill level.

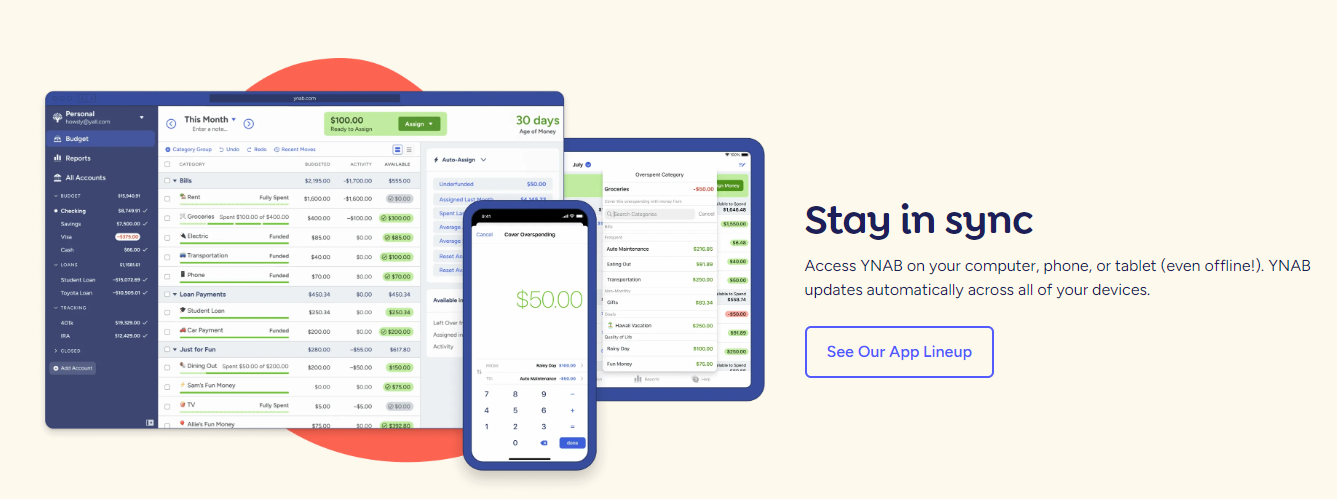

Multi-Device Compatibility: Using YNAB Across Platforms

Whether you’re a loyal Android user, an Apple fan, or someone who prefers working on a desktop, YNAB has you covered. The app ensures seamless compatibility and offers a consistent experience across various devices.

First, let’s chat about YNAB on Android. The YNAB app is fully available on Android phones and tablets. You can do pretty much everything on your Android device that you can do on the desktop version. Track expenses, adjust your budget, and monitor your financial goals right from your phone while you’re on the go.

For the iPhone and iPad crowd, YNAB works like a charm. The iOS version is just as robust, allowing you to manage your finances effortlessly. Whether splitting a bill at dinner or checking your budget before purchasing, you have all the tools you need in your pocket.

When using YNAB on a desktop, Windows and Mac users can download and install the app. The desktop version offers a broader view and is perfect for detailed budget sessions. It’s all about giving you flexibility to choose how and where you manage your money.

What’s really cool about YNAB is how smoothly it syncs across your devices. You can start a budget adjustment on your phone and finish it on your laptop without missing a beat. This cross-platform functionality ensures that your data is always up-to-date, no matter where you are.

Pros, Cons, and Trustworthiness of YNAB

YNAB offers several benefits that make it a popular choice among budget-conscious users. The hands-on approach encourages proactive financial management and helps you develop better money habits. The app’s real-time syncing across devices ensures that you have the most up-to-date information at your fingertips, helping you stay on top of your budget no matter where you are.

One of the standout features is the built-in financial education. YNAB isn’t just an app; it’s a tool that teaches you smart budgeting techniques. The budgeting principles and goal-setting tools can make a huge difference, especially if you’re new to managing your money.

However, no app is without its drawbacks. One potential downside is the learning curve. If you’re not used to detailed budgeting, YNAB may initially feel overwhelming. It takes some time to get accustomed to entering every transaction and updating your budget. Additionally, YNAB isn’t free. There’s a subscription fee, which might be a dealbreaker for some people, especially if you’re on a tight budget.

When it comes to trustworthiness, YNAB is highly regarded. It uses bank-grade security measures to protect your data, including encryption and two-factor authentication. YNAB has a transparent privacy policy and does not sell your data to third parties. The community of users and numerous positive reviews online vouch for the app’s reliability and helpfulness.

In essence, YNAB can be a game-changer for managing your finances, despite a few hurdles. If you’re willing to invest the time to learn and adapt to its system, you’ll likely find it to be an invaluable tool.

I absolutely loved your insightful review of the YNAB app on Travel Made Personal! Your detailed breakdown really highlights the strengths and versatility of the tool. I’m intrigued, how does YNAB accommodate unexpected expenses or financial emergencies in its budgeting approach? Also, considering its focus on financial discipline, have you discovered any unique YNAB features that make budgeting not just practical but also enjoyable? Lastly, how does YNAB stack up against other budgeting tools for long-term financial goals? Thanks for sharing such valuable content!

Gabriel John

Hi Gabriel,

Thank you so much for your thoughtful message! I’m thrilled to hear that you found the review of YNAB on Travel Made Personal insightful. It’s truly a versatile tool for managing finances, especially when it comes to staying on top of a travel budget!

To answer your questions, YNAB is built to handle unexpected expenses and financial emergencies quite well. The “True Expenses” category encourages you to plan for irregular costs, like car repairs or medical bills, by setting aside small monthly amounts. If something unexpected does come up, YNAB allows you to quickly reallocate funds from less urgent categories to cover the expense without derailing your entire budget.

One feature I’ve found to make budgeting more enjoyable is YNAB’s goal-setting function. It’s rewarding to set a financial goal—whether for a trip, a major purchase, or an emergency fund—and watch your progress. The app also gives you little positive nudges when you’re making progress, which keeps things motivating and fun!

Regarding long-term financial goals, YNAB stands out by focusing on building healthy habits over time. Its emphasis on giving every dollar a job helps you stay disciplined and focused on what’s essential, even for large, long-term savings. Compared to other tools, I find YNAB excels at teaching you to think about your money more proactively.

Thanks again for reaching out, Gabriel! If you have any more questions or want to explore YNAB or other tools further, feel free to connect. Happy budgeting!

Best regards,

~Ki

Travel Made Personal

You did a great job explaining how the app helps users take control of their finances, and I appreciated the section where you broke down the features in a simple, understandable way. I didn’t realize YNAB could be so customizable for different financial goals. I’m curious, do you think it’s better for beginners, or would someone with more budgeting experience benefit more? Also, I noticed you mentioned the subscription fee—do you think the cost is worth it compared to some of the free budgeting tools out there? Thanks for such a helpful review!

Hi Bob,

Thank you so much for your kind feedback! I’m glad the breakdown of YNAB’s features resonated with you, especially how customizable it is for different financial goals. It’s one of the reasons I believe the app can suit a wide range of users.

To answer your question, I think YNAB can be incredibly beneficial for both beginners and more experienced budgeters. For beginners, it offers a structured yet flexible approach that helps them quickly grasp the basics of budgeting. YNAB’s method—like assigning every dollar a job—makes it easy to start taking control of your finances right away.

For more experienced users, YNAB’s detailed reports and customizable categories provide deeper insights into spending and saving habits. It’s also great for fine-tuning long-term financial goals and ensuring your money works toward the right priorities. So, no matter where you are in your financial journey, YNAB has something valuable to offer.

Regarding the subscription fee, I do think it’s worth the investment, especially if you’re committed to sticking with a budgeting tool long-term. The educational value and continuous improvements and features set YNAB apart from many free apps. That said, it depends on how much you value the added support and structure YNAB provides compared to free alternatives.

I appreciate you taking the time to read the review and contact me with your questions. Feel free to contact me again if you want more insights or suggestions!

Best regards,

~Ki

Travel Made Personal

Hello,

This is such a detailed and helpful review of YNAB! I love how it breaks down both the benefits and challenges, especially for those of us who might find budgeting overwhelming at first. The proactive approach to managing finances really stands out and the fact that YNAB teaches you to prioritise your spending is such a game-changer.

I also appreciate the multi-device compatibility, you can truly manage your money from anywhere, which makes budgeting more accessible and convenient. The emphasis on syncing in real-time across all platforms makes staying on top of finances so much easier.

Thank you for sharing this with us!

Hi there,

Thank you so much for your kind words! I’m delighted to hear that you found the review helpful and detailed. Budgeting can feel overwhelming at first, but YNAB’s proactive approach truly makes a difference by helping you prioritize your spending and take control of your finances.

Multi-device compatibility is one of my favorite features, too! Managing your budget from anywhere and having real-time syncing across all platforms adds so much convenience to the process. It’s great to hear that these features resonated with you as well.

Thank you again for reading the review and sharing your thoughts. Feel free to reach out if you have any questions or need further insights!

Best regards,

~Ki

Travel Made Personal

hi, The YNAB app stands out as a powerful budgeting tool that goes beyond simple expense tracking and I appreciate how it emphasizes the importance of understanding the “why” behind spending habits, making it more than just a tracking tool; it’s a comprehensive financial education resource. But how does the YNAB app effectively help users manage their finances compared to traditional budgeting methods, and what specific features contribute most to its success?

Hi there,

Thank you for your thoughtful message! I’m glad you picked up on one of YNAB’s most vital aspects—it goes beyond simple expense tracking by helping users understand their spending habits and reasons. This understanding makes it a valuable financial education tool, not just a budgeting app.

Compared to traditional budgeting methods, YNAB encourages a much more proactive and flexible approach. Traditional methods often rely on static budgets, which you plan at the beginning of the month and hope to stick to. YNAB, however, focuses on giving every dollar a job and adjusting as circumstances change, allowing you to stay more engaged with your finances day-to-day.

One feature that contributes most to its success is the “age of money” concept, which teaches you to live off the money you earned at least 30 days ago. This habit builds a buffer and helps users break the paycheck-to-paycheck cycle. Additionally, the real-time syncing across multiple devices ensures you’re always up to date with your budget, even if you share it with a partner or need to check in while on the go.

YNAB also promotes flexibility by allowing you to adjust your budget easily as new priorities or unexpected expenses arise, something traditional methods need to handle better.

Thank you for the great questions! Feel free to reach out if you’d like more insights on specific features or comparisons. I’d be happy to help!

Best regards,

~Ki

Travel Made Personal

This is a really thorough review, and I love how you broke down YNAB’s main features! The philosophy of giving every dollar a job is such a smart way to approach budgeting, and it’s refreshing that YNAB focuses on mindful spending rather than restricting everything. I also appreciate how user-friendly it seems, especially with the seamless syncing across devices. Your explanation makes it sound like a great tool for anyone wanting to take control of their finances—definitely considering giving it a try now!

Hi there,

Thank you so much for your kind feedback! I’m glad the review resonated with you, especially YNAB’s approach to giving every dollar a job. It’s a much more mindful way to budget, allowing flexibility while keeping your finances in check. That balance between control and freedom is what makes YNAB so effective!

The seamless syncing across devices adds to its user-friendly nature, making it easy to stay on top of your budget from anywhere. I’m thrilled to hear you’re considering trying it—I’m confident it could be a great tool for helping you take control of your finances.

If you decide to try it out and have any questions, feel free to contact me. I’d be happy to help!

Best regards,

~Ki

Travel Made Personal

Never heard of this before but I’m a competitive market YNAB looks awesome and something I’ll download .

article covers everything, and most importantly the pros and cons , easy links to get the app .

I see there are lots of apps like this but this one is certainly reviewed and sold well during the article .

an enjoyable read , thank you .

Hi there,

Thank you so much for your kind words! I’m glad you found the article helpful, especially the breakdown of YNAB’s pros and cons. It’s a competitive market with many budgeting apps, but YNAB stands out for its unique approach to mindful spending and financial organization.

I’m thrilled to hear you’re considering downloading it! Once you start using the app, feel free to reach out if you have any questions or need tips. I’d love to help in any way I can.

Thanks again for your feedback, and I hope you enjoy using YNAB as much as I do!

Best regards,

~Ki

Travel Made Personal